Growing your business through profiling

When building your team it is important to understand not only their capacity for the workload, their education level, but also their personality traits. This will help you to connect with your team in a more effective, productive and efficient manner.

Building an effective team and understanding what drives persons will ultimately lead to the following events:

- Your team will become more effective

- Productivity will increase

- You will be a more effective leader/manager/supervisor

- You will gain the respect of others by understanding how to truly connect with their human nature.

- Your conflict management will become more effective.

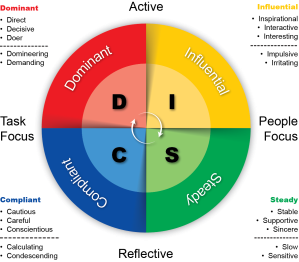

The most popular mode of gauging personality’s traits is to use the D-I-S-C profiling system. This system puts persons into four (4) specific categories based the key traits which they possess.

These categories are :

The dominant (D)

- Sees the big picture

- Can be blunt

- Accepts challenges

- Gets straight to the point

This person is all about the facts, not much fluff. Results are the main goal of this character trait.

The Influencer (I)

- Very Optimistic

- Very friendly

- Dislikes being ignored

- Like to collaborate

This person tends to persuade others to follow their lead

Steady (S)

- Humble

- Calm

- Dislikes being rushed

- Supportive

This person can be a great team player. They are known to be cooperative, and dependable.

Conscientiousness/Compliant (C)

- Independent

- Objective

- Wants the details

- Fears criticism.

This person’s main focus is accuracy and quality through existing circumstances

Companies take the time to research these categories because productivity and achieving a better bottom line is key. Your team is the main driver for your business, and if they are neither motivated nor engaged, your company’s interest will not be at heart and the true potential will not be reached.

Tax Day Deadline Extended 25/3/15

Tax Day Deadline Extended

Tax Administration Jamaica (TAJ) wishes to advise the public that the deadline for the filing of Income Tax Returns has been extended to March 25, 2015. This means that Self-employed individuals, partnerships, companies, other bodies and employed persons with additional sources of income will be able to file on or before the extended deadline without the imposition of any penalty being applied. Persons are however urged to file and pay on or before the extended due date to avoid the usual last minute rush.

Self-employed persons are reminded that they are to use the new S04, S04a or combination Smart Form to submit their annual return and estimated income, taxes and contributions, for 2014 and 2015 respectively. These forms conveniently capture payments for income tax, education tax, as well as NHT and NIS contributions for self-employed persons. Individuals are therefore no longer required to visit multiple agencies, or use

multiple forms, at various times, to meet their statutory obligations.

The S04 forms for self-employed persons, as well as the revised Income Tax forms for other categories of persons are available for download from the TAJ website at www.jamaicatax.gov.jm. Persons are advised to use the version of the form that relates to the applicable filing year, as the income tax forms have been revised to reflect recent legislative changes.

Small Business Operators are encouraged to make use of the free tax support sessions, which are still being offered across the island. At these sessions business persons will be guided by TAJ representatives on how to prepare the new Self Employed Annual Return (S04) and revised Income Tax forms now due March 25.

Taxpayers who wish to use the free service are being asked to take with them all business related documents, which include their Taxpayer Registration Number (TRN), bank statements, purchase invoices, receipts, sales records, utility bills, wage records and any other records that can be used to verify income and expenses.

Taxpayers who fail to file by the extended March 25 due date, are reminded that a $5,000 penalty can be charged for each month the return is late.

For further information persons may visit the TAJ Tax Portal at www.jamaicatax.gov.jm or contact the TAJ Customer Care Centre at 1-888-TAX-HELP (1-888-829-4357) or any Tax Office.

GCT Act

After the amendments made to the General Consumption Tax act (GCT) in 2014, lets take a look at how the law currently stands.

This article will highlight a few key areas.

Who Is Required To Register?

All persons engaged in a taxable activity are required to apply for registration under the GCT Act.

Exemption from Registration

Anyone engaged TOTALLY in the following will NOT have to register for GCT:–

- any activity carried on essentially as a private recreational pursuit or hobby;

- any engagement, occupation or employment under any contract of service or as a director of a company;

- any good or service which is exempt from the GCT (Third Schedule of the General Consumption Tax Act).

The Threshold for having to register.

The Threshold is set at gross value of supplies of three million dollars ($3,000,000.00). The Threshold amount is the consideration paid or payable on all supplies made. Where a person is engaged in both taxable and exempt activities, the amount received from exempt supplies must be included when computing the gross value of supplies.

There are four basic types of returns:

- The General Consumption Tax return (form 4A ) which this guide explains and describes;

- GCT return form 4A, (Standard Return) is to be used by all Registered Taxpayers

- The Special Consumption Tax return (form 4C) which is to be filed by the manufacturers of prescribed goods, namely.The Tourism Activities Tax return (form 4D) which is to be filed by persons who carry out a tourism activity; and

- Alcoholic beverages

- Tobacco products and

- Petroleum products.

- The Tourism Activities Tax return (form 4D) which is to be filed by persons who carry out a tourism activity; and

- The General Insurance Tax return (form 4E) which is to be filed by persons carrying out general insurance services

For 4B has been discontinued and no longer available for download.

When to File Your Return

As a Registered Taxpayer, you will be required to file a General Consumption Tax Return on form 4A within one month of the end of your taxable period. For example for taxable period July 2012, the monthly return would be due to be file on or before August 31, 2012.

GCT on Imported Goods and Supply

General Consumption Tax (GCT) is levied and collected at the time goods are entered for home consumption under the Customs Act. The person importing the goods is liable to pay the GCT to Customs on the same document which is used to pay the Customs Duty.

Registered Taxpayer importing services subject to tax are required to self-assessed and account for the GCT (this mechanism is called a reverse charge)

Supply for the purposes of the GCT Act includes:‑

- the sale, transfer or disposition of goods by a Registered Taxpayer so that the goods sold, transferred or otherwise disposed of no longer form part of the assets of a taxable activity;

- the exercise of a power of sale by a person ‑other than a registered taxpayer in satisfaction of a debt owed by a Registered Taxpayer; and

- the provision of services.

Application for registration

To apply for registration, a person must complete a GCT Application Form, Registration form – GCT‑ 1 . The form may be obtained online or from a TAJ Tax Office/Collectorate or Revenue Service Centre. To be able to register for GCT, a person must have a valid Business Taxpayer Registration Number (TRN). Where an applicant does not have a valid TRN, he must apply for same at the Taxpayer Registration Centre (TRC) or Tax Office/ Revenue Service Centre (RSC). The application form for the TRN may be obtained online or from any TAJ Tax office or the TRC.

Any person starting a taxable activity after the 22nd October 1991 has twenty‑one (21) days after starting this taxable activity to make an application to register.

Failure to apply for registration makes you liable to a penalty equal to:

- Two hundred dollars ($200.00) for each complete month of the period of non‑registration in the case of a person liable to be registered as a Registered Person; OR

- Five thousand dollars ($5,000.00) in the case of person liable to be register as a registered taxpayer and the person is an individual and in the case of a company, ten thousand dollars ($10,000.00). In addition interest of two and one-half percent (2 ½%) per month of the tax liability for the period unregistered.

CANCELLATION OF REGISTRATION

The Commissioner General may cancel the registration of a Registered Person if he is satisfied that the person no longer carries on a taxable activity. He may also cancel the registration of a Registered Taxpayer if he is satisfied that the Registered Taxpayer no longer qualifies for registration as such.

Before cancellation, the Commissioner General will notify the Registered Person or Registered Taxpayer of his intention, stating the reason.

Any person notified of a proposed cancellation may object. This objection must be made within thirty days of the date of service of the notice and must be in writing, stating precisely the grounds of the objection.

If the Commissioner General, after consideration of an objection decides to cancel a registration, he must inform the person in writing of the decision and of the right of appeal. Where the person is a Registered Taxpayer, he must return the Certificate of Registration to the Commissioner when notified of the decision.

Failure to return to the Commissioner General of Tax Administration the Certificate of Registration is an offence against the Act.

Other points of interest

Also affected within this amendments is the deferment system which previously only applied to manufacturers of taxable supplies, which are those suppliers of goods that attract GCT, and only inputs acquired for use in the manufacture of taxable goods.

Now it has been amended to benefit manufacturers, who are engaged in mixed activities (which includes) the production of goods, which are taxable and also exempt goods on which GCT does not apply.

The act also outlines the accounting requirements for GCT, and how to record GCT for both the accrual and cash basis.

Assets Tax (Specified Bodies) Act

Every specified body (described below) shall make and submit to the Inland revenue an annual declaration of the value of its assets and shall in relation thereto pay the tax prescribed in the Schedule. Schedule.

Specified body

(a) A company within the meaning of the Companies Act, other than a company in respect of which a licence has been granted pursuant to Section 16 of that Act by the Minister responsible for the administration of companies.

(b) A society registered under the Industrial and Provident Societies Act

(c) Such other body as may be prescribed by Order subject to negative resolution.

Filing & Payment Due date

Asset tax is a current year tax due and payable on an annual basis. The return is due and payable by March 15 of the same year and shall be based on the financial statements for the permitted accounting period.

Returns to be used

The existing Asset Tax Return (Form AT01) has been modified to reflect the amendments to the asset tax act (ATA). Form (AT02) is developed for Specified Regulated Entities Other specified bodies will continue to use the current Asset Tax Return (Form AT01)

Tax rate

The tax rate is to be applied to the taxable value of the assets. (a) For the Specified Regulated Entities, a rate of 0.14% is to be applied to the taxable value of the assets.

(b) For other entities, tax is payable in accordance with the schedule set out in table below:

| Value of the asset | Annual Tax | |

| Less than $50,000 | J$ 5,000 | |

| At least $50,000 but less than $0.5M | J$ 25,000 | |

| At least $0.5M but less than $5M | J$ 100,000 | |

| At least $5M but less than $50M | J$ 150,000 | |

| At least $50M | J$ 200,000 |

Value of the Asset

(A) For the BOJ regulated entities (the assumed asset tax base is):

The taxable value of the assets is the Aggregate Value of Assets minus [IFRS and Prudential Loan Loss Provisions] minus Withholding Tax Receivables owed by GOJ minus Required Capital. “Required Capital” as defined in the Second Schedule “IFRS and Prudential Loan Loss Provisions” means to “Loan Loss Reserves”

(B) For the FSC regulated entities:

(a) Security Dealers: The taxable value of the assets is the Aggregate Value of Assets minus Regulatory Capital minus Withholding Tax Receivables owed by GOJ. “Regulatory Capital” as defined in the Second Schedule “Withholding Tax Receivables” refers to the gross carrying value at the balance sheet date of tax withheld at source on interest and owed by the Government of Jamaica (Commissioner General Tax administration).

(b) Life Insurance Companies: The taxable value of the assets is Aggregate Value of Assets minus Withholding Taxes Receivables owned by GOJ minus Required Capital minus Assets Supporting Annuity Liabilities. “Required Capital” as defined in the Second Schedule “Withholding Tax Receivables” refers to the gross carrying value at the balance sheet date of tax withheld at source on interest and owed by the Government of Jamaica (Commissioner General Tax administration).

(c) General Insurance Companies: The taxable value of the assets is Aggregate value of Assets minus Withholding Tax Receivables owed by GOJ minus Required Capital minus Reinsurance Recoverables. “Required Capital” as defined in the Second Schedule “Withholding Tax Receivables” refers to the gross carrying value at the balance sheet date of tax withheld at source on interest and owed by the Government of Jamaica (Commissioner General Tax administration).

Value of Asset for Other Specified Bodies:

According to the asset tax act (ATA), the value of the asset shall be aggregate of the following:

(a) Any estate or interest in land

(b) Equipment, furniture, machinery, plant and other movable property

(c) Any other interest, right or benefit

(d) Outstanding balances on loans and advances made by the specified body

(e) The specified body’s cash in hand and in bank deposit

(f) Outstanding balances due to the specified body by sundry debtors other than those specified in sub-paragraph (d)

Exemption

- Credit Unions remain exempt from this tax regime. Upon becoming regulated, the applicable asset tax base applies.

- Charitable organizations

- Not for profit organizations

Final Tax & Income Tax Treatment

Asset tax is a final tax.

The tax is not allowable as a deduction under the Income Tax Act. Amendments have been made to sections 13 and 15 of the Income Tax Act. This is effective for YA 2013 Income Tax Return and after.

Tax Administration new Payroll Thresholds as of January 1, 2015

The Tax Administration Jamaica (TAJ) has announced that on January 1, 2015 an increase in the income tax threshold will take effect.

The new threshold or tax-free income will move to $557,232 per annum, up from $507,312 per annum, TAJ said in a statement Monday.

TAJ said that the increase in the threshold means the corresponding tax-free portion to be used by employers in making periodic payments is as follows:

$10,716 weekly

$21,432 fortnightly

$46, 436 monthly

$139,308 quarterly

Income in excess of the threshold will continue to be taxed at 25 per cent.

TAJ explained that with the increase in the threshold, the tax paid per annum by each individual will reduce by $12,480 while the net effect for each individual per quarter will be a reduction in tax of $3,120.

Self-Employed individuals are advised that the new threshold is to be used to file their estimated income tax return for the 2015 year of assessment, due March 15 and make payments for the same year in four equal instalments by March 15, June 15, September 15 and December 15 of each year.

Termination and Redundancy Payments and lump sum payment

When an individual’s employment is terminated, the terms of payments as they relate to entitlement to tax free payment, are governed by the Employment (Termination and Redundancy Payment) Act.

This guide does not seek to explain how the entitlement works; it will only explain how to calculate the amount that should not be taxed.

The Income Tax (Termination of Employments) Order 1971, determines what should not be taxed when a payment is made.

Payment in lieu of notice, sick pay and vacation pay should not be calculated as a part of the Redundancy amount, but will be part of the Redundancy package. Statutory deductions should be applied to these payments in the normal way, as well as the portion of the redundancy payment that is not exempt.

The formula to be used to calculate the tax-free portion is for example:

2 ¼ x Average Salary for the last 3 Years x number of Years of Service

33 1/3 Years

Salary in Year 10 (June 2006 – May 2007) $1,200,000

Salary in Year 9 (June 2005 – May 2006) $1,000,000

Salary in Year 8 (June 2004 – May 2005) $ 980,000

Total $3,180,000

Average Salary for last 3 Years – $3,180,000 = $1,060,000

3

Use the formula for the tax-free portion, the amount is:

2 ¼ x $1,060,000 x 10 Years’ Service = $715,500

33 1/3

Total Redundancy payment $1,000,000

Less tax free portion $ 715,500

Taxable amount $ 284,500

Tax payable 284,500 x 25% $ 71,125

Payment to be made to Employee $1,000,000-$71,125 = $928,875

Information gathered from Tax administration of Jamaica

For more information contact Bogle and Company at bogleandcompany.com